Introduction

In this article, I’m going to show you how to secure residency and citizenship in Spain for you and your family through business and investment. I’m going to cover the four main options for you. They are:

- investing €500,000 euros in real estate

- investing in a business project in Spain which is considered to be of “general interest”

- investing €1 million euros in bank deposits, investment funds, or shares or equity in a company

- investing €2 million in Spanish public debt

2. REQUIREMENTS

In this first article, we will focus on the real estate investment option. We’re also going to go through an example at the end of this video, to illustrate how you can have your Spanish citizenship granted after 10 years of residency.

EU second residency programs offer increased freedom of movement and, potentially, an excellent second passport.

Spain launched their ‘golden visa’ programme in 2013.

Under this programme, for a 500,000 euro real estate investment in Spain, you and your family are then entitled to EU residency, giving not only access to Spain but also the ability to move freely within the EU and Schengen area.

So, the Spanish real estate visa route is potentially a very attractive option if you’re looking to the European Union for your second residency.

1. APPLICATION PROCESS

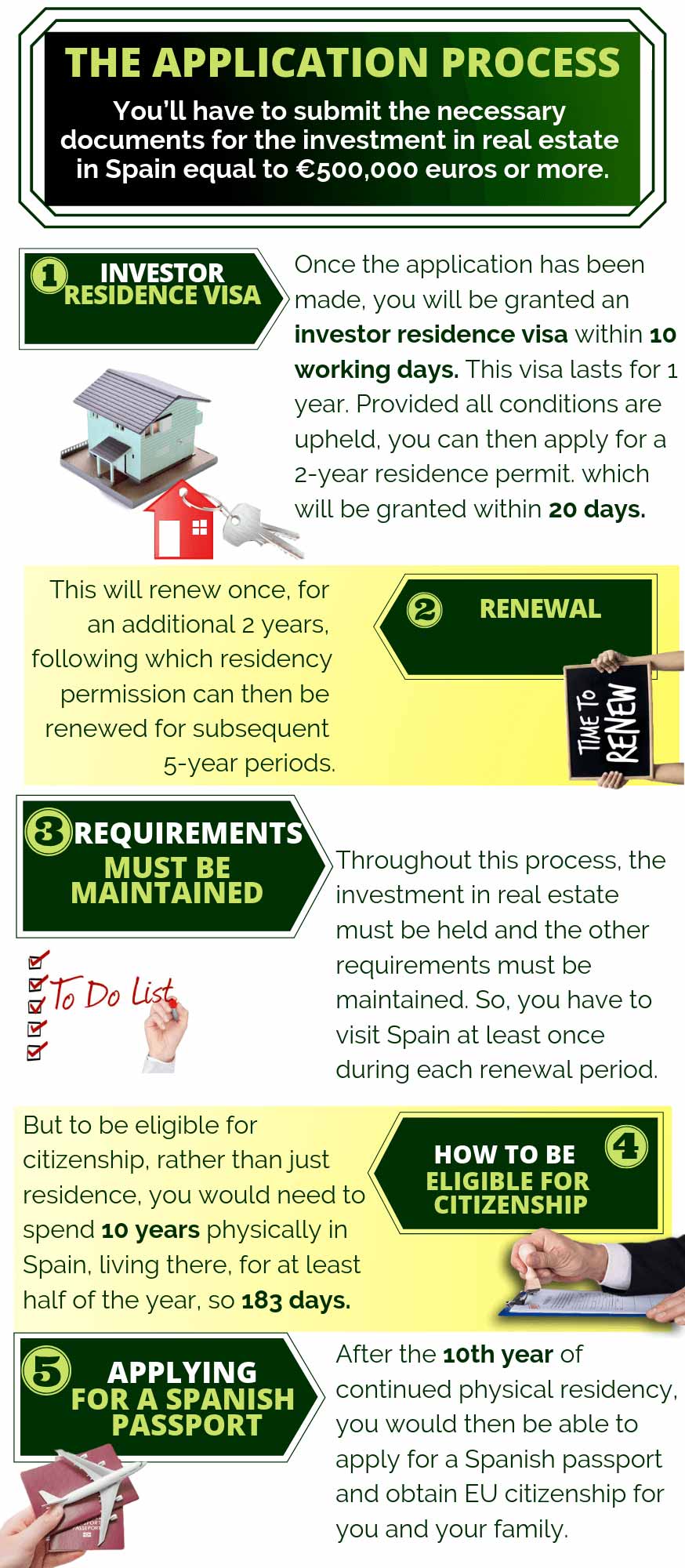

Now, let’s make a start on the practical steps you can take to secure residency and citizenship in Spain through investing 500,000 euros in property.

You appoint a representative who is able to apply for, and then renew, the residency visa on your behalf. This means you can make your applications from your current country of residence outside of the EU.

So you don’t even have to physically live in Spain in order to secure, retain and renew the visa. The only requirement is that you must visit Spain at least once during each period of residence.

You apply as the main applicant. You can bring your wife, along with your dependant children aged 18-24 and your children under 18.

You can also bring your parents and your wife’s or spouse’s parents if they satisfy the test of being ‘elderly and dependant family members’. This means they are unable to provide for themselves due to their age or health. They can apply either jointly or after you have already been granted your residence visa.

2. REQUIREMENTS

The real estate investment of 500,000 euros must be made either by you directly, or by a company owned by you. So if it’s through your company, you must have the majority of the voting rights and you must be able to appoint the majority of the management board of the company. And this company can’t be registered in a tax haven.

As part of the application, you must prove that you have acquired or have invested in Spanish real estate by including certification documents. You must apply for the residency visa within 90 days of these documents being issued. So, basically, you’ve got to be ready to apply for the residency visa shortly after your real estate purchase is completed.

When you bring family members with you, you must have evidence of sufficient financial resources to support you and your family members who depend on you. This means you need evidence of at least €2,130 euros for yourself and €532 euros per month for each dependant family member.

You also must have private medical insurance for you and your family for the duration of your residency permission.

Lastly, you need clear criminal records from your current country of residence for at least 5 years.

3. PROS AND CON

Let’s now look at some of the advantages and also some of the challenges involved in this route.

On the plus side, after a period of price declines and low real estate prices from around 2014, the Spanish property market has considerable potential for gains over the coming years.

This recovery is still underway but prices are still well below the equivalent of many other popular European locations, even in Spanish city centres.

So this means property prices are fairly affordable in comparison so other EU countries.

However, some would say that this is a riskier investment compared to buying property in some other EU countries, perhaps Germany for example. Unemployment among young people is also quite high in Spain.

Bear in mind that in order to become a Spanish citizen, you have to spend at least 183 days, or half of the year, in Spain, for 10 years. This means that if you are going for citizenship, rather than just residency, you’ll likely become a tax resident and therefore tax planning should be part of your consideration. If you need advice on this front, get in touch with me and I have tax lawyers who can assist with the tax-planning aspect.

Just to get down to illustrate these points, let’s look at a hypothetical example of Edward.

So first, Edward, having taken advice from me and my Spanish lawyer, decides that the 500,000 euro real estate route is the best option for him to secure EU residency and citizenship.

Once Spanish citizenship is granted, Edward and his family are naturalised as Spanish citizens – and therefore become EU citizens. So they are then able to live and work, for example, in any of the European Union member states, such as Germany or Italy.