The Portugal D7 ‘passive income’ visa

Overview

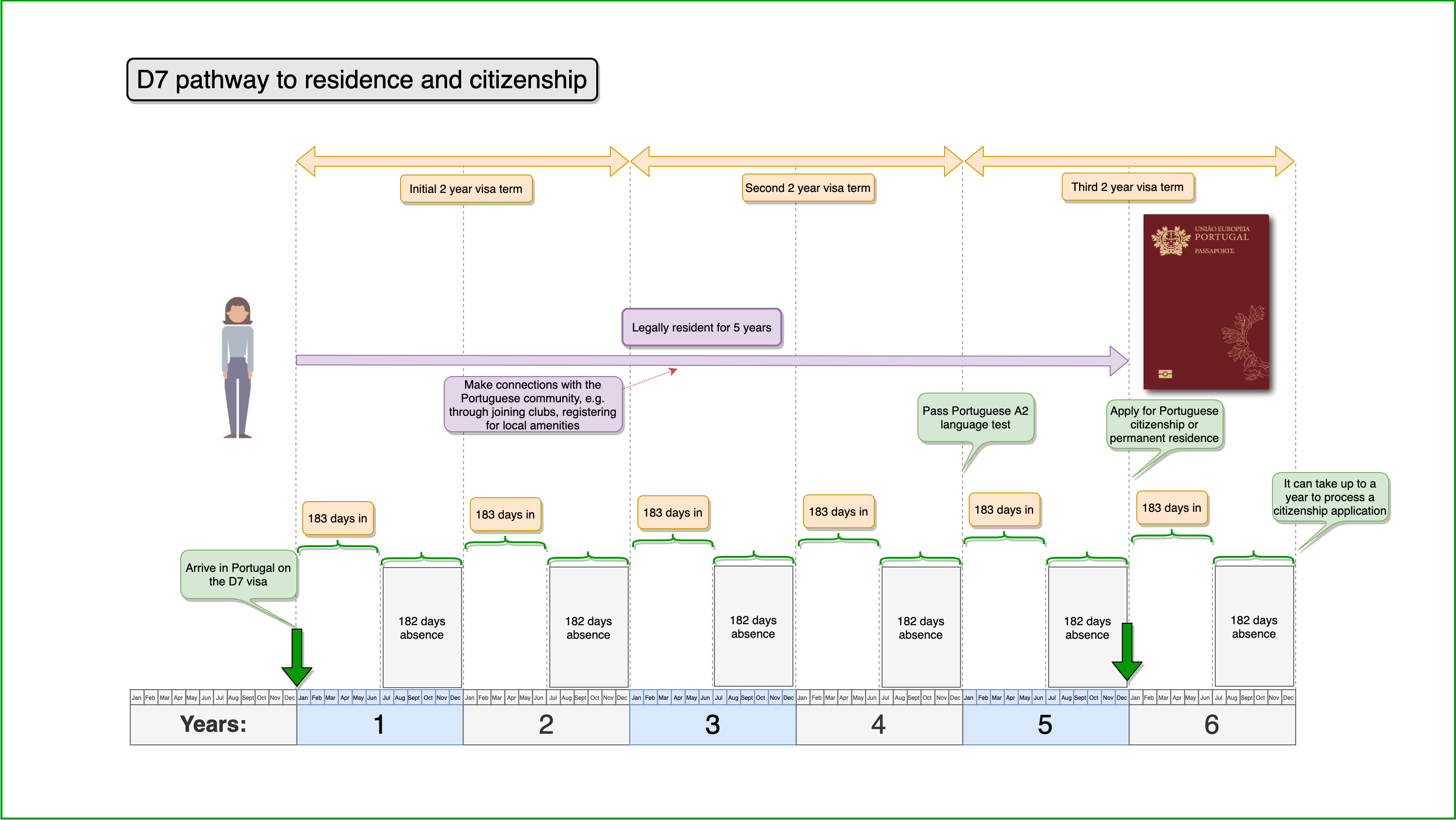

The Portuguese D7 visa is one of the only EU visas which puts you on a pathway to permanent residence and EU citizenship where you can qualify purely on the basis that you have an income from financial investments, for example, a pension or rental income. I’m going to explain how it works in these videos with these easy-to-understand diagrams. It can be a great alternative to the golden visas and investor visas, which generally require you to invest large sums of money. The point is you have large sums of money available to invest, then you will probably qualify for the D7 visa, but the advantage is you can do it without making any investment and without carrying any of the associated financial risks.

Eligibility: how much passive income do you need for the D7 visa?

How much passive income do you need for the D7 visa? This is essentially the Portugese minimum wage, which is low. This has been increased slightly for 2021. It is broken down as follows:

(a) The first adult must meet 100% of the Guaranteed Minimum Monthly Remuneration (so €665 euros per month);

(b) Second and any further adults must meet 50% of the Guaranteed Minimum Monthly Remuneration (so €332.5 euros per month); and

(c) Dependent children (younger than 18) must meet 30% of the Guaranteed Minimum Monthly Remuneration (so €199.5 euros per month).

Bear in mind that the type of income is important. The Portugese legislation refers to “visa applications made by foreign citizens who live on income from financial investments” (Article 24(d) of Regulatory Decree No. 84/2007). So having an income from working will not qualify. What would usually qualify would be, for example:

- Your income from your pension;

- Dividends from your company (providing you are not playing an active role in the management of your company); or

- Rental income from your financial investments in rental properties.

This is not an exclusive list and there may also be other kinds of income that can qualify as income from financial investments.

Visa process

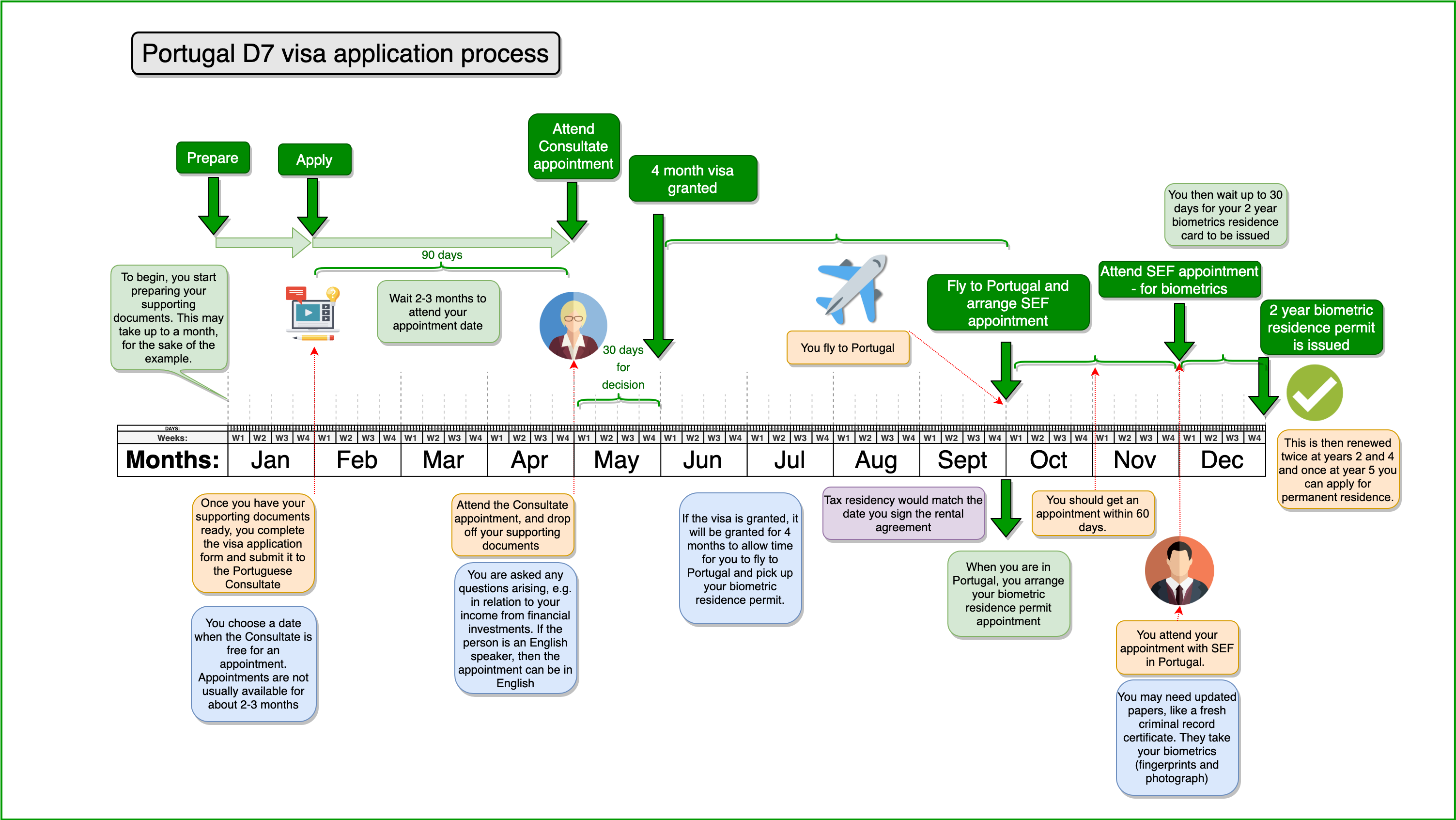

The Portuguese D7 visa process takes place in 10 stages. You should allow for 6 to 12 months up until you receive the visa:

- To begin, you start preparing your supporting documents. This may take up to a month, for the sake of the example;

- Once you have your supporting documents ready, you complete the visa application form and submit it to the Portuguese Consultate;

- You choose a date when the Consultate is free for an appointment. Sometimes appointments are not available for 2-3 months;

- Attend the Consulate appointment, and drop off your supporting documents. You are asked any questions arising, e.g. in relation to your income from financial investments. If you are an English speaker, then the appointment can be in English;

- The decision will usually be made within 30 days;

- If the visa is granted, it will be granted for 4 months to allow time for you to fly to Portugal and pick up your biometric residence permit;

- When you are in Portugal, you arrange your biometric residence permit appointment. You should get an appointment within 60 days;

- You attend your appointment with SEF. You may need updated papers, like a fresh criminal record certificate. They take your biometrics (fingerprints and photograph);

- You then wait up to 30 days for your 2 year biometrics residence card to be issued;

- This is then renewed twice at years 2 and 4 and once at year 5 you can apply for permanent residence.

What are the supporting documents required for the D7 residence permit?

You will need to provide these documents:

- Proof of subsistence (the Guaranteed Minimum Monthly Remuneration) can take the form of a statement of responsibility, signed by a Portuguese national or by a foreign national legally resident in Portugal;

- The D7 Visa application form;

- Passport or additional travel document valid for 3 months after the duration of the stay;

- Two passport photos, up-to-date and with enough quality to identify you;

- Valid travel insurance, allowing medical coverage, including medical emergencies and repatriation;

- Proof of being in a ‘regular’ situation where you are applying from one country, but are a national of another country (i.e. that you are not currently in breach of immigration law in the country from which you are applying for the D7 visa);

- Request for criminal record details by the Immigration and Border Services (SEF);

- Criminal record certificate from the country of origin or the country where the applicant is residing for over a year (children under the age of 16 are exempt from producing a criminal record);

- Proof that you can subsist without recourse to public funds.

What are the Portuguese D7 visa fees?

As for visa fees, for a “Long Stay Visa” the visa fee is 99 euros. For children aged 6-11 there is a reduced fee of 35 euros.

How can you use the Portuguese “Non-Habitual Residence” tax regime?

There is a special tax regime in Portugal designed to attract foreign investors and retirees, called the “Non-Habitual Residence” program. It secures qualifying individuals zero income tax on certain foreign sourced income for 10 years. “Non-habitual residence” refers to you not having been a habitual resident of Portugal previously (in other words, before you arrive on your D7 visa). To take advantage of it, you need to be in Portugal for 183 days per year. I will do a separate video on the “Non-Habitual Resident” program. So on this diagram I have set that out, with you being out of Portugal for a maximum of 182 days. It is a D7 visa requirement that you live in Portugal in any event. In relation to the D7 visa term, the initial visa is for 2 years, and this is renewed twice for you to get to the 5 year point at which you can then apply for permanent residence and citizenship.