Maintenance funds for a UK start up visa are possibly the one thing that can derail an innovator visa application if not handled correctly, and with adequate planning.

In this course module we will cover:

Overview

The first thing you need to do, before proceeding further, is to check your maintenance funds. If it’s just you applying, and you are not bringing family members, then the relevant sum is only £945. A small amount like £945 is not a big deal, right? Wrong. I have seen a number of cases now where maintenance funds have not been maintained in the way required by the rules, before people pursue an endorsement.

1. The rule and process ⚠

So, what is required? You must show that you, as main applicant, have £945, and that each of your family members has an additional £630. The purpose of the rule is to show that you can pay for yourself when you come to the UK.

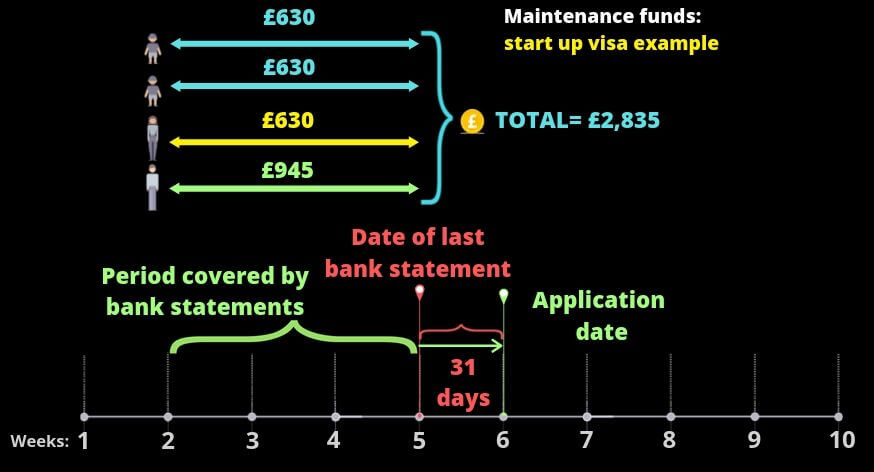

If your wife (or husband) is coming with you to the UK, and you are also bringing your two children, then you will need £630 + £630 + £630 + £945 = £2,835. Here is a diagram showing this example:

The key requirements are at paragraphs W3.9 (g)-(k) of Appendix W of the Immigration Rules:

The rules on start up visa funds

(a) The applicant must have at least £945 .

(b) If a main applicant and their partner or children are applying at the same time, there must be enough maintenance funds in total, as required for all the applications, otherwise all the applications will be refused.

(c) The funds in (a) above must be held in a personal bank or building society account, where the applicant is the account holder (or one of the account holders in the case of a joint account).

(d) Where the funds are in one or more foreign currencies, the funds will be converted to pound sterling (£) using the spot exchange rate which appears on oanda.com for the date of application.

(e) The funds will not meet the maintenance requirement if any of the following apply:

(i) The funds are in a financial institution listed in Appendix P of the Immigration Rules.

(ii) The funds are not in cash. The decision maker will not accept evidence of shares, bonds, credit cards, overdraft facilities or pension funds.

(iii) The applicant was in the UK illegally, or in breach of their leave conditions, when they obtained any of the funds.

(f) The funds must have been held in the account for a consecutive 90 days, ending no earlier than 31 days before the date of application.

So, in summary there are 7 requirements and you can use this checklist to go through them:

- 1. You have at least £945, plus £630 for each dependent.

- 2. These sums will be at that level on the date of the online application, according to oanda.com

- 3. The funds are in cash or fixed deposits, rather than in shares, bonds, credit cards, overdraft facilities or pension funds.

- 4. If the funds are in a bank listed in Appendix P, the bank is listed as a bank which is recognised by the Home Office.

- 5. You were not in the UK illegally, or in breach of their leave conditions, when they obtained any of the funds.

- 6. The funds must have been held in the account for a consecutive 90 days, ending no earlier than 31 days before the date of application.

- 7. The evidence you have of the funds satisfies the documentary requirements (see the further checklist below)

2. Supporting document checklist (start up visa funds) 📝

The rules for start up documents on funds, which you need to know, are here at paragraphs W3.9 (g)-(k) of Appendix W of the Immigration Rules:

The rules on supporting documents

(g) The applicant must provide evidence of the above, which may be in any of the following forms:

(i) personal bank or building society statements

(ii) a building society pass book

(iii) a letter from their bank or building society

(iv) a letter from another financial institution regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) for the purpose of personal savings accounts

(v) a letter from an overseas financial institution regulated by the official regulatory body for the country in which the institution operates and the funds are located

(h) The evidence in (g) must show all of the following:

(i) the name of the account holder

(ii) the account number

(iii) the financial institution’s name and logo

(iv) that the funds in the account have been at the required level throughout the 90-day period

(v) the date of each document

(vi) in the case of personal bank or building society statements, any transactions during the 90-day period

(i) Bank or building society statements must not be mini-statements from automatic teller machines (ATMs) and must be one of the following:

(i) statements printed on the bank’s or building society’s letterhead

(ii) electronic statements, accompanied by a supporting letter from the bank or building society, on company headed paper, confirming the statements are authentic

(iii) electronic statements, bearing the official stamp of the bank or building society on every page

(j) The end date of the 90-day period will be taken as the date of the closing balance on the most recent document provided . Where documents from two or more accounts are submitted, this will be the end date for the account that most favours the applicant.

(k) If the applicant is applying in the Start-up or Innovator categories, they do not need to provide evidence of maintenance funds if the letter from their endorsing body confirms they have been awarded funding of at least £945 . In the case of Innovator applicants, this must be in addition to the £50,000 investment funds required in that category.

I have prepared this checklist so that you can check your documents satisfy the requirements:

The process is essentially first to select what type of evidence you are relying on to show the maintenance funds, i.e. either:

- personal bank or building society statements

- a building society pass book

- a letter from their bank or building society

- a letter from another financial institution regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) for the purpose of personal savings accounts or

- a letter from an overseas financial institution regulated by the official regulatory body for the country in which the institution operates and the funds are located

- (rare) a confirmation in the endorsement letter that the endorsing body has awarded £945

… THEN you should check it against this checklist, to confirm that in the case of documents 1-5 above:

- 1. it shows the name of the account holder

- 2. it shows the account number

- 3. it shows the financial institution’s name and logo

- 4. it shows that the funds in the account have been at the required level throughout the 90-day period

- 5. it shows the date of each document

- 6. it shows in the case of personal bank or building society statements, any transactions during the 90-day period

… THEN you should check it against this checklist, to confirm:

- 7. The end date (the date of the closing balance on the most recent document provided) is within 90 days of the online application date.

- 8. You satisfy all of the requirements under the ‘Requirements Checklist’ above.

3. Start up visa (funds) case studies, tips and stories ❗

Case study 1: Dipping below the threshold but recovering on the same day

One of my start up visa clients had funds which dipped below the threshold of his relevant personal account, but they were immediately made up on the same day, to a sum well above the threshold. I understand that there have been cases where the Home Office has accepted such evidence. However, there is no basis in the rules or guidance for the proposition that only the closing balance on the end of a particular day within the period is relevant. So I would not recommend trying this. Just wait until your 90 days has accrued if there is such an issue.

⚠Tip 1: Credit cards

Sorry, these are not permissible to show maintenance funds. The funds must be in the form of cash funds held in an account. This does include savings accounts and current accounts, but it does not cover credit cards!

⚠Tip 2: Multiple accounts

You can rely on multiple accounts to show maintenance funds, but I would not recommend it unless you really have to. The rules say that you can take the closing balance of the account that most favours you, and use any other monies from any other accounts to make up the funds required.

⚠Tip 3: Joint accounts

Again, this can be done, but I’d recommend just planning ahead and having your maintenance funds in your own personal account in your name alone.

⚠Tip 4: The right bank

Just to amplify a point I commented on above. Your maintenance funds must not be in a bank on the ‘blacklist‘ of the Home Office. Appendix P of the Immigration Rules shows you which banks are accepted, and which ones are not. But Appendix P only applies to certain countries. So if you are not on one of those countries listed, then you can assume that the bank statements will be accepted. Within the countries listed, e.g. India and Pakistan, certain banks are blacklisted, and others are expressly allowed.

⚠Tip 5: What if you don’t have the maintenance funds, or you have a dip, or you can’t get the evidence?

Hold off on getting the endorsement letter until you do.

Case study 2: Getting the endorsement letter but having an issue with maintenance funds

I know of an example where someone secured an endorsement letter but it turned out that they did not have the maintenance funds after all. Since there is a 3 month expiry date on the endorsement letter, and it would take 3 months to accrue the 90 day period to prove the maintenance funds, the application could not proceed.